Planning to invest your money, but does not know which mutual fund would be apt to invest in? No worries, we are for your help. Here we have listed some of the best performing mutual funds in India that offers the highest and consistent returns. Before moving to the top-performing funds, let’s brush up on our understanding about mutual funds and the types of funds available for different kinds of investors.

Table of Contents

Basics of Mutual Fund

In the layman language, mutual fund is a financial vehicle that collects money from several investors and invests the same money in different securities such as bonds, stocks, short term debts etc. Mutual Funds typically invest their corpus into diversified portfolio encompassing equity shares, debt, debt-equity hybrid, corporate bonds, government securities etc. Investors can invest in the preferred mutual fund and their allocated units, commensurate to their investment as well as the Net Asset Value (NAV) of a unit of that particular fund. The net asset value of the particular fund is calculated by dividing the total value of the assets held by a fund in underlying security to the total outstanding number of shares. The investor has to pay an expense ratio for the mutual fund in which they have invested.

The financial performance of a mutual fund can be analysed through the change in the NAV of the fund. As the NAV rises, the investors can expect capital gains on their invested corpus. However, if the NAV of a fund falls, then the investor can stand to lose their invested capital. Thus, it is important for an investor to keep track of the financial performance of the fund(s) in which they have invested and make timely exit decision.

One of the common misconceptions people have regarding mutual funds is that it is linked to stock market only. Which is not the case, if you are a risk-averse investor then you can choose to invest in the debt instruments which usually carry lower risks, however, promise lower return as well. Besides this, you can always invest in any of the best performing mutual funds based on the return you are getting or can expect and the historical consistency of the fund.

Types of Mutual Funds

Before moving to the top-performing mutual funds in India, one should know about different mutual funds and their significance. There are several types of mutual funds that represents the kind of securities in which investment has to be made and the type of return one will get. Some common types of mutual funds are equity fund, debt funds, debt-equity hybrid funds, exchange-traded funds, index funds, gilt funds etc.

Different Categories of Funds

1. Equity Funds

Equity or stock funds invest primarily in stocks traded on a daily basis at the stock exchange. The equity funds are often classified according to the size of the underlying assets, that is, large-cap, mid-cap and small-cap. They are also categorised according to their approach towards investment, such as aggressive investment approach, long-term capital appreciation approach, contrarian investment strategy etc. They can also be categorised according to the sector in which they invest, for instance, infra funds, health sector funds etc. Some Equity funds also offer the investors a choice to invest in foreign equities.

2. Debt Funds

Debt funds invest their corpus in debt instruments that help in selling and buying loans in exchange for interest. These are considered to be less risky and offer less return as compared to the Equity Funds. But it generates a fixed income such as corporate bonds, treasury bills, government securities, commercial papers. The dates of the instruments and the interest rate that the investor will get are pre-decided. The returns are not affected by the fluctuations in the stock. Thus, they are at low risk.

3. Hybrid Funds

High Breed Funds are a combination of debt and equity securities. Each hybrid fund calls for a different combination of both securities, depending on the type of investment. It creates a balanced portfolio and offers a regular income with capital appreciation. Hybrid Funds are risky riskier than debt funds and offers better returns; however, they are less risky than equity funds.

Top-Performing Mutual Funds in India 2021

Top-Performing Mutual Funds in India 2021 Here we have listed all the best performing mutual funds in India. Thus funds are based on the best and consistent percentage of returns they offer each year.

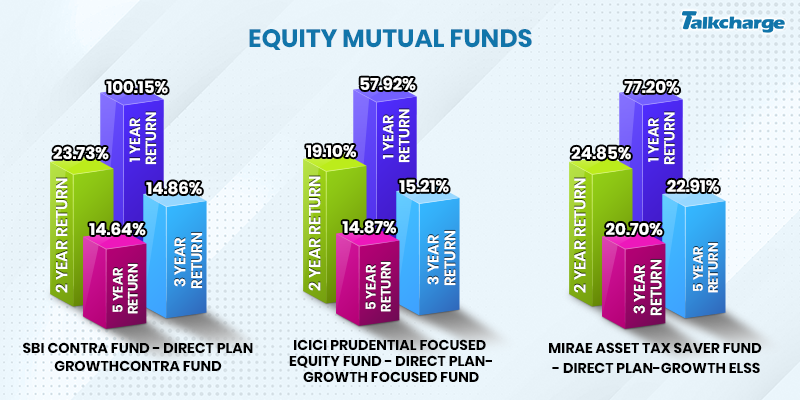

Equity Mutual Funds with Best and Consistent Returns

| Name of Top Performing Mutual Funds | 1 Year Return | 2 Year Return | 3 Year Return | 5 Years Return |

| SBI Contra Fund – Direct Plan – GrowthContra Fund | 100.15% | 23.73% | 14.86% | 14.64% |

| ICICI Prudential Focused Equity Fund – Direct Plan-Growth Focused Fund | 57.92% | 19.10% | 15.21% | 14.87% |

| Mirae Asset Tax Saver Fund – Direct Plan-Growth ELSS | 77.20% | 24.85% | 20.70% | 22.91% |

| Nippon India Focused Equity Fund – Direct Plan – Growth Focused Fund | 81.02% | 18.93% | 14.16% | 17.10% |

| SBI Blue Chip Fund – Direct Plan-Growth Large Cap Fund | 60.93% | 16.16% | 13.18% | 13.81% |

Top Performing Debt Mutual Funds

| Name of Best Performing Mutual Funds | 1 Year Return | 2 Year Return | 3 Year Return | 5 Years Return |

| DSP Banking & PSU Debt Fund – Direct Plan-Growth Banking and PSU Fund | 6.30% | 9.00% | 9.28% | 8.40% |

| ICICI Prudential Banking & PSU Debt Fund – Direct Plan-Growth Banking and PSU Fund | 7.16% | 8.64% | 8.81% | 8.42% |

| SBI Contra Fund – Direct Plan-Growth Contra Fund | 100.15% | 23.73% | 14.86% | 14.64% |

| ICICI Prudential Corporate Bond Fund – Direct Plan-Growth Corporate Bond Fund | 7.54% | 8.99% | 9.13% | 8.41% |

| HDFC Credit Risk Debt Fund – Direct Plan-Growth Credit Risk Fund | 12.79% | 10.14% | 9.64% | 9.06% |

| DFC Dynamic Bond Fund – Direct Plan-Growth Dynamic Bond Fund | 5.30% | 10.20% | 10.85% | 9.47% |

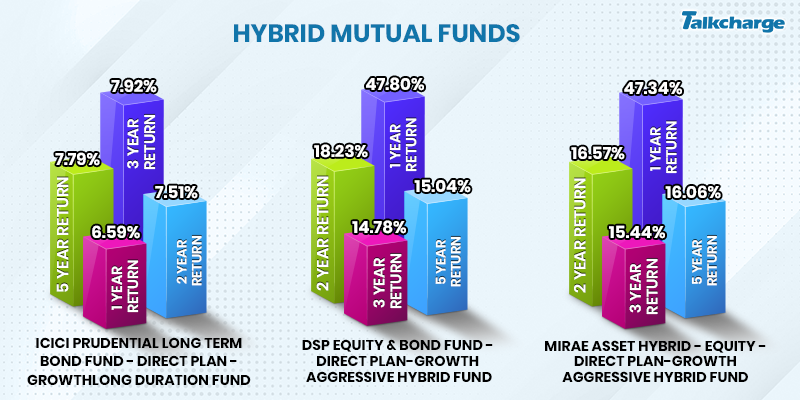

Best Performing Hybrid Mutual Funds India 2021

| Name of Best Mutual Funds | 1 Year Return | 2 Year Return | 3 Year Return | 5 Years Return |

| ICICI Prudential Long Term Bond Fund – Direct Plan – GrowthLong Duration Fund | 6.59% | 7.51% | 7.92% | 7.79% |

| DSP Equity & Bond Fund – Direct Plan-Growth Aggressive Hybrid Fund | 47.80% | 18.23% | 14.78% | 15.04% |

| Mirae Asset Hybrid – Equity – Direct Plan-Growth Aggressive Hybrid Fund | 47.34% | 16.57% | 15.44% | 16.06% |

| Nippon India Arbitrage Fund – Direct Plan-Growth Arbitrage Fund | 4.06% | 5.18% | 5.93% | 6.35% |

| Canara Robeco Conservative Hybrid Fund – Direct Plan-Growth Conservative Hybrid Fund | 18.82% | 12.88% | 11.89% | 10.38% |

| ICICI Prudential Multi-Asset Fund – Direct Plan – GrowthMulti Asset Allocation | 48.17% | 16.04% | 13.15% | 15.36% |

Parameters of Selecting Mutual Funds

- On the basis of your learning about mutual funds, select the one that fits your requirement or the objective of the investment.

- Consider risk tolerance factor; for example, equity funds are riskier than debt funds and hybrid funds. And debt security is less risky. And hybrid funds are less risky than debt funds, so it completely depends on how much risk you wish to take.

- Consider the return value of all the mutual funds. Make sure you invest in the one that gives you high return value. Also, you would have to understand the fact that you will not get the same return always; the return value would fluctuate. So you should be prepared for the same.

- Adding to the previous point, the investor should pay wattage to the mutual funds that offer consistent returns. This means if any of the funds is offering you 10% constant rate and another fund is offering you 18% at first and then 15%, then go for the one that offers you a 10% return regularly.

- Systematic Investment Plan (SIP) is a key to learn investing discipline.

Conclusion:

If you are planning to invest in mutual funds, make sure that you choose the one that is performing and offers a consistent return rate. There are mainly three types of mutual funds, which are Equity, Debt and Hybrid. All these three mutual funds are different from each other. Once you have invested in any of the Mutual Fund, make sure that you monitor its performance on your respective fund house. Also, if your mutual fund is open-ended, you can any time withdraw your money.

FAQs

You can bank upon fund fact sheet. It shows the performance of all the mutual funds that is managed by your fund house. It also includes your investments.

The performance of the mutual fund can be calculated by dividing the absolute change in NAV by the start date of NAV.

You would have to start with the KYC. Submit a copy of your Account number, proof of residence and age proof to your fund house, go through all the schemes and consider the risk factor involved. You would have to provide your bank details for the same. Many of the Fund houses also have their mobile application through which you can invest in mutual funds online.

Yes, one has to pay taxes on his or her earning of mutual funds.

You can redeem your money from a mutual fund if it is an open-ended fund. One can withdraw from debt and equity funds as soon as the funds are available for repurchase and sale.