UTR full form is Unique Transaction Reference Number, which is used to identify a transaction in India. This unique number is generated to determine the transfer of the funds. Your bank creates this through the transaction is done.

The Unique Transaction Number can be found on the bank statement as Ref. No. below are your transaction details. According to the RBI norms, the UTR no. has 16-digit codes and 22 characters long for RTGS. Take the UTR number SBI example, such as XXXXAYYDDD999999. XXXX stands for bank code like SBI’s bank code is SBIN, and A in the code refers to system identifier, YY stands for two digits of the year, such as 19 for 2019, and DDD is a Julian date such as 032 for Feb 1. And 999999 is 6 digit sequence number.

* In the UK, UTR number meaning is Unique Taxpayer Reference Number. It is not similar to the Indian UTR no.

Table of Contents

Unique Transaction (UTR) Number Uses & Role of NEFT & RTGS

UTR number means a Unique Transaction Number that helps to monitor financial transactions. It can also be used to track your funds’ transfer.

In India, it is generated while transferring money from one bank to the other. There are two methods to transfer the money from your respective bank. One method of online money transfer through a bank is NEFT, and the other is RTGS.

NEFT refers to National Electronic Funds Transfer. Such a transaction is processed in batches, so the transfer is not immediate.

RTGS refers to Real-Time Gross settlement. Funds are immediately transferred through RTGS. It does not take more than 2 hours to deposit the money into the beneficiary account. Though it is the fastest method but can only be used if the transaction amount is above Rs. 2,00,000. There are two types of UTR numbers- RTGS and NEFT UTR no. Users can easily make tracking through their respective bank apps.

Steps to Find UTR Number

If you don’t know how to find UTR number in Axis bank, SBI bank, or HDFC bank, then follow these steps-

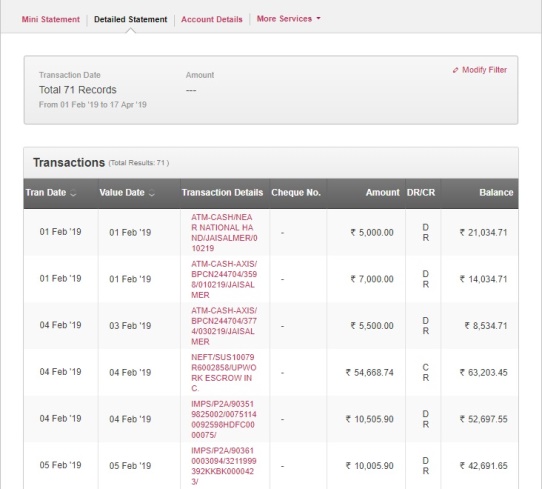

- To find Unique Transaction Number, you can go through the detailed account statement in the online banking section.

- Subsequently, click on the transaction details. The detail of the particular transaction will appear.

- In the same detail, you will find UTR no.

- The Unique Transaction Number is visible on the statements of the banks like ICICI, SBI, Axis, and HDFC.

How to Track Neft Transaction Status With UTR No.?

Method 1:

- Go to your internet banking account or open the mobile App of your respective bank.

- Go to the past transaction section.

- Look for the particular transfer, and the Unique Transaction number, along with the transaction status, will be displayed on the same page.

Method 2:

Call the customer care number of your bank and provide them your Unique Transaction no. to get all the necessary details.

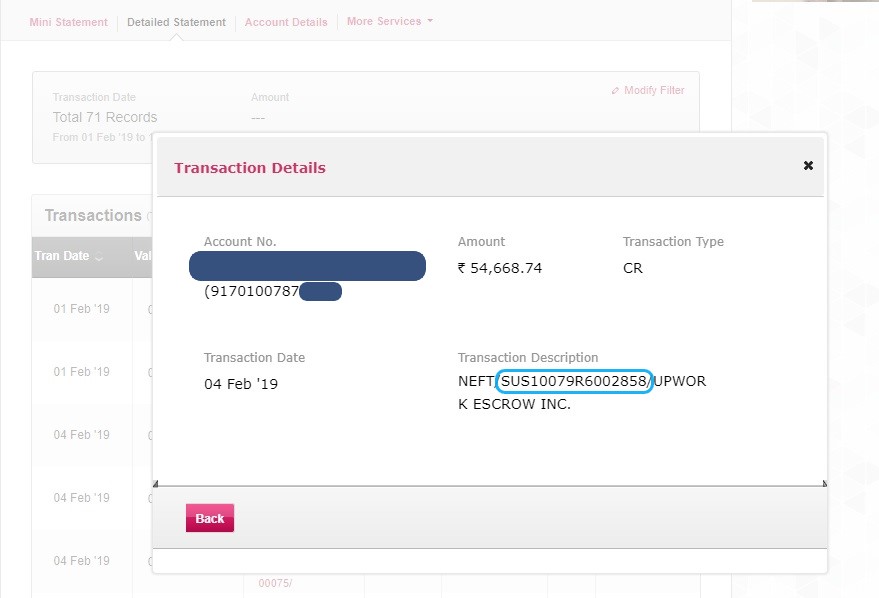

Example of Axis Bank:

1. Open the App and click on ‘’Detailed Statement’’.

2. Then, click on ‘’Transaction Details’’. A pop-up would come along with the UTR reference of the specific transaction.

3. Use the UTR for status follow-up for the particular transaction.

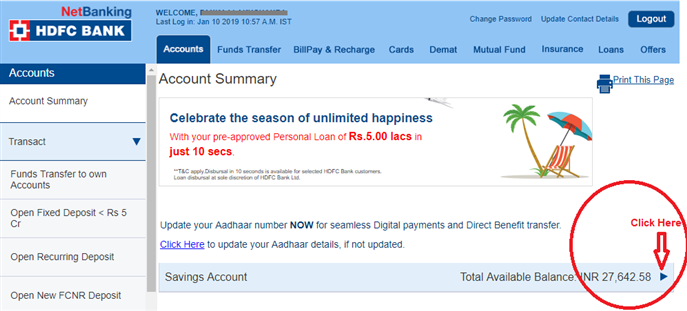

Example of HDFC Bank:

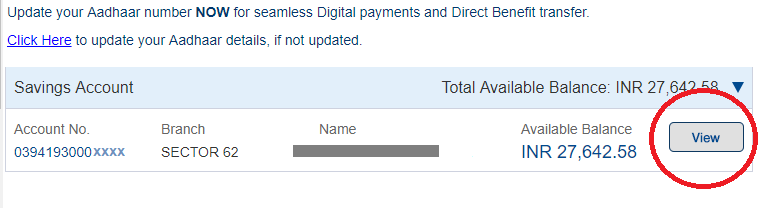

1. Log in to the HDFC bank account. On the top of the page (on the left), there would Accounts Section.

You might also like: How to Track HDFC Credit Card Status

2. Beneath Accounts, you will find an Arrow. Click the arrow, and soon the details of the account along with the ”View” button will appear.

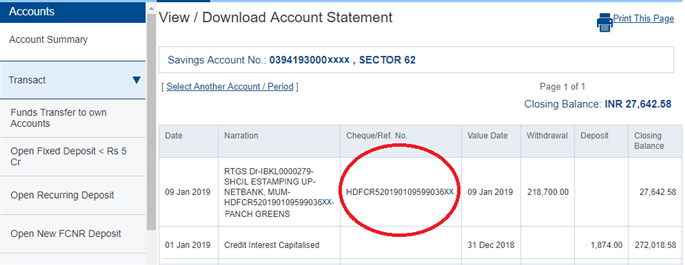

3. Click on the ‘’View Button’’. Your account statement will be displayed after that.

*In this way, you will know how to get UTR number in HDFC bank. The number marked in the red circle is the UTR no. for HDFC bank users. Above image shows how to do HDFC UTR number tracking online. You can similarly find SBI UTR number through SBI mobile app or its official website.

Conclusion

UTR refers to the Unique Transaction number in India. It helps to track and find past transactions that have been made through your bank account. Every bank like ICICI and HDFC shows a UTR no.

FAQs

UTR number means Unique Transaction reference number. It is used for NEFT and RTGS transactions. For every transaction, the bank provides a UTR no., which you can use for any query related to the transaction in the future.

You can visit your internet banking account or open the bank app. alternatively, you can call the customer care team of the bank for help.

According to the RBI, the UTR no is 16 numbers long, and as per RTGS, it has 22 characters.

UTR full form is Unique Transaction Number.

Unique Transaction Reference (UTR) is a reference number that is used to identify transactions made through IMPS, RTGS, or NEFT.

You can call SBI customer care number 1800112211, 18004253800, or 080-26599990 in order to check the number in YONO SBI.

Above, we have explained step-by-step procedures to track through RTGS and NEFT. We have also provided a UTR number example for easy understanding.

In order to find UTR number in Axis bank, go to the online banking section and then visit the account statement. Thereafter, tap on the transaction details so as to track Axis bank UTR number.

The easiest way to track HDFC UTR number of HDFC bank is from your saving accounts statement. Just download this statement from your internet banking or through HDFC mobile app.

You can cross-check a specific bank transaction with the help of UTR number.

A UTR number is a unique reference number made for all transactions to find transactions comprising the fund transfer.